Neighborhood Lending Partners Staff

-

Debra Reyes

- President / CEO

- (813) 879-4525

Position carries primary responsibility for all company planning and organizational oversight, including the business plan that projects its growth and direction. Manages all company operations and is responsible for establishing systems and procedures to maximize efficiency and effectiveness. Has primary responsibility for oversight and completion of company's business development activities.

Oversees company resources, including staff. Responsible for company's financial status to ensure profitability, company programs and services to ensure high quality and profitable products that fulfill NLP's mission. Oversees loan production at levels consistent with the approved budget and that portfolio is profitable and of high quality.

-

Carlos Rivas

- EVP, Chief Financial Officer

- (813) 879-4525 Ext. 214

Directs the financial affairs of the organization and prepares financial analysis of operations, including interim and final financial statements with supporting schedules for the guidance of management.

Responsible for the company's financial plans and policies, accounting practices, maintaining of fiscal records and preparing financial reports.

Involves supervision of general accounting, property accounting and maintenance, budgetary controls loan servicing, Information and Technology systems and Human Resources.

-

Mary Fellows

- EVP / COO

- (813) 879-4525 Ext. 211

Mary Fellows is NLP's EVP/COO. Mary has over 10 years experience in contract management and compliance reporting for state and federal programs.

Mary also tracks program impact to insure NLP's operations are in alignment with the Company's overall mission. She has created compliance mechanisms and maintained records, and completed the reporting for NLP's CDFI and HUD awards. Mary worked for several regional and community banks as a commercial lender and underwriter prior to coming to NLP. Mary received a BBA from Roanoke College.

-

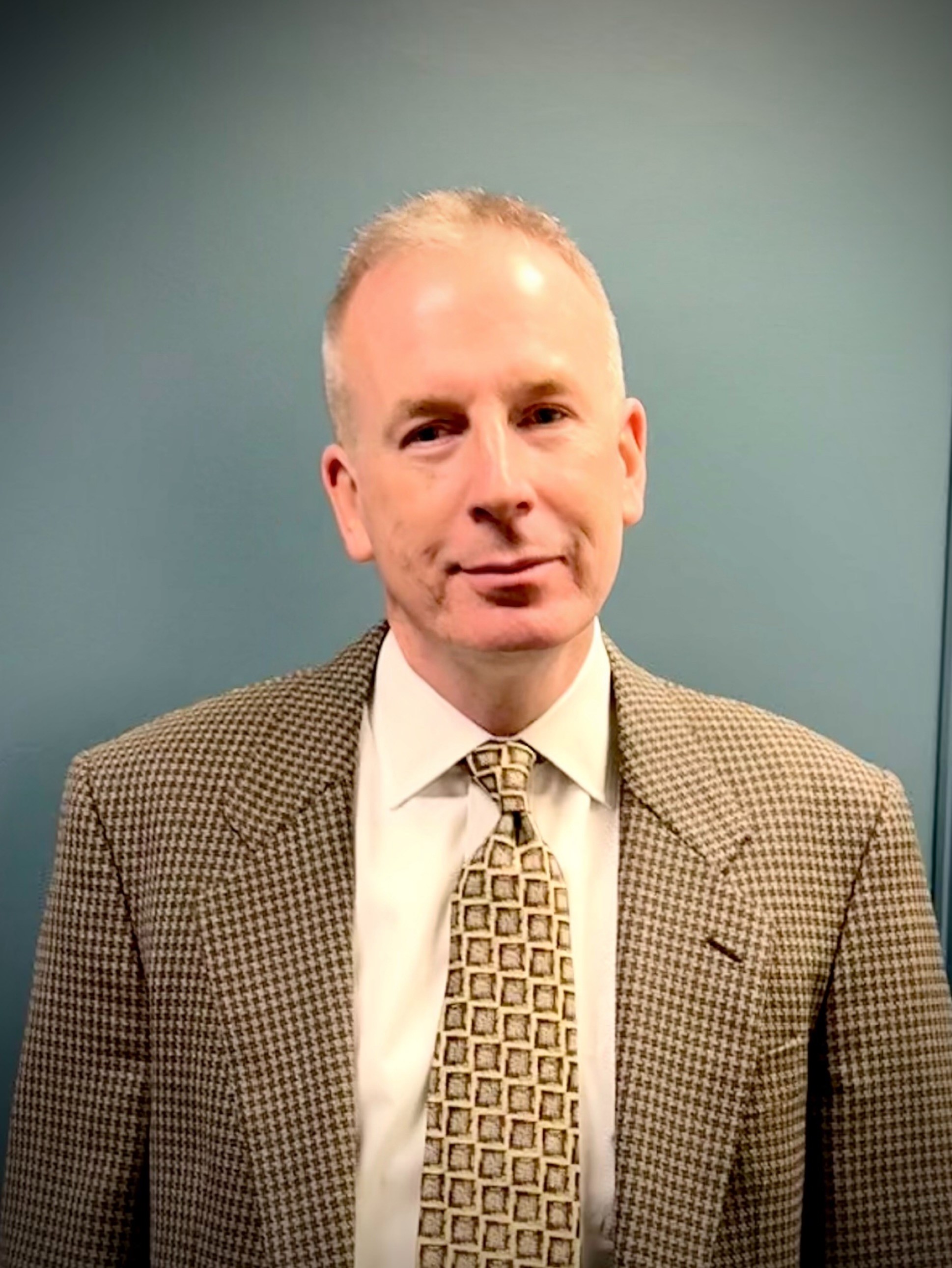

Kevin A. Fitzgerald

- Senior Vice President

- (813) 879-4525 Ext. 223

Kevin A. Fitzgerald is Senior Vice President, Portfolio Manager and Underwriter, overseeing loan performance. He has more than twenty-five years of experience in community development. After graduating from Syracuse University with a Bachelor of Architecture, Cum Laude, Kevin practiced architecture for ten years, including as an Associate at Robert A.M. Stern Architects. For five years he was the Director, Center for Emerging Professionals at the American Institute of Architects in Washington, DC.

Kevin graduated from The University of Maryland College Park with a Master of Real Estate Development, where he also served in the University Senate. For eight years Kevin worked for nationally known affordable housing syndicators, as a Senior Development Risk Manager, notably at Enterprise Community Investment. Kevin’s focus at NLP is on the loan portfolio’s performance and compliance, county compliance services, while also underwriting transactions. Kevin is a dedicated community volunteer and mentor, having served on multiple boards in elected and appointed positions, where he champions thriving, diverse neighborhoods.

-

Damon Asbrook

- AVP, Loan Performance Analyst

Mr. Asbrook is responsible for property and rental compliance analyses on Affordable Housing projects. Overall reviews of property performance, adherence to regulatory guidelines and underwriting are the expectations of the role. He works closely with the Portfolio Manager in efforts to meet reporting deadlines on both performing and criticized assets.

Mr. Asbrook began his banking career while studying economics at the University of Maryland. Recruited into a management trainee program, he transitioned into credit analysis and remained on this path throughout his career. Expanding his knowledge and analytical skills in Small Business and Commercial credit review, he was regarded as a senior lender and earned the title of Vice President with the Bank of America. Market conditions resulted in a change in direction, leading to a role as a Senior Commercial Portfolio Manager in a Special Assets capacity. On both Retail and Commercial platforms, his experience of nearly thirty years has served him well.

-

Kris Byrem

- AVP Corporate Secretary / Marketing Director

- (813) 879-4525 Ext. 200

With over 20 years of experience as an AVP Corporate Secretary and Marketing Director, I bring deep expertise in business administration, corporate governance, and marketing across the banking, affordable housing, and community development sectors. As the gatekeeper to the CEO, I manage corporate operations including document maintenance, membership records, meeting coordination, and HUD DRGR system administration for the NSP2 program.

I also lead all marketing initiatives—overseeing the company website, social media presence, and promotional materials to ensure consistent branding and impactful communication. Passionate about creating positive social impact, I strive to build meaningful relationships with stakeholders, partners, and communities. I am a commissioned notary and hold certifications in email marketing, Google Ads, Google Analytics, and AI Digital Marketing from the University of South Florida.

-

Marcus Taylor

- AVP, Construction Closing Loan Administrator

- (813) 879-4525 Ext. 227

Marcus Taylor is a veteran finance leader specializing in the intersection of operational precision and community revitalization. With over 15 years of experience navigating commercial lending and residential underwriting for major national institutions, Marcus joined NLP in March 2025 to spearhead Construction Closing operations in Tampa, Florida.

He operates under a philosophy of "Velocity without Compromise," expertly managing the complexities of Commercial Real Estate loans. By deconstructing the loan lifecycle, Marcus identifies critical efficiencies and mitigates risk long before construction begins.

Marcus is dedicated to managing progress and ensuring every closing serves as a catalyst for community development.

-

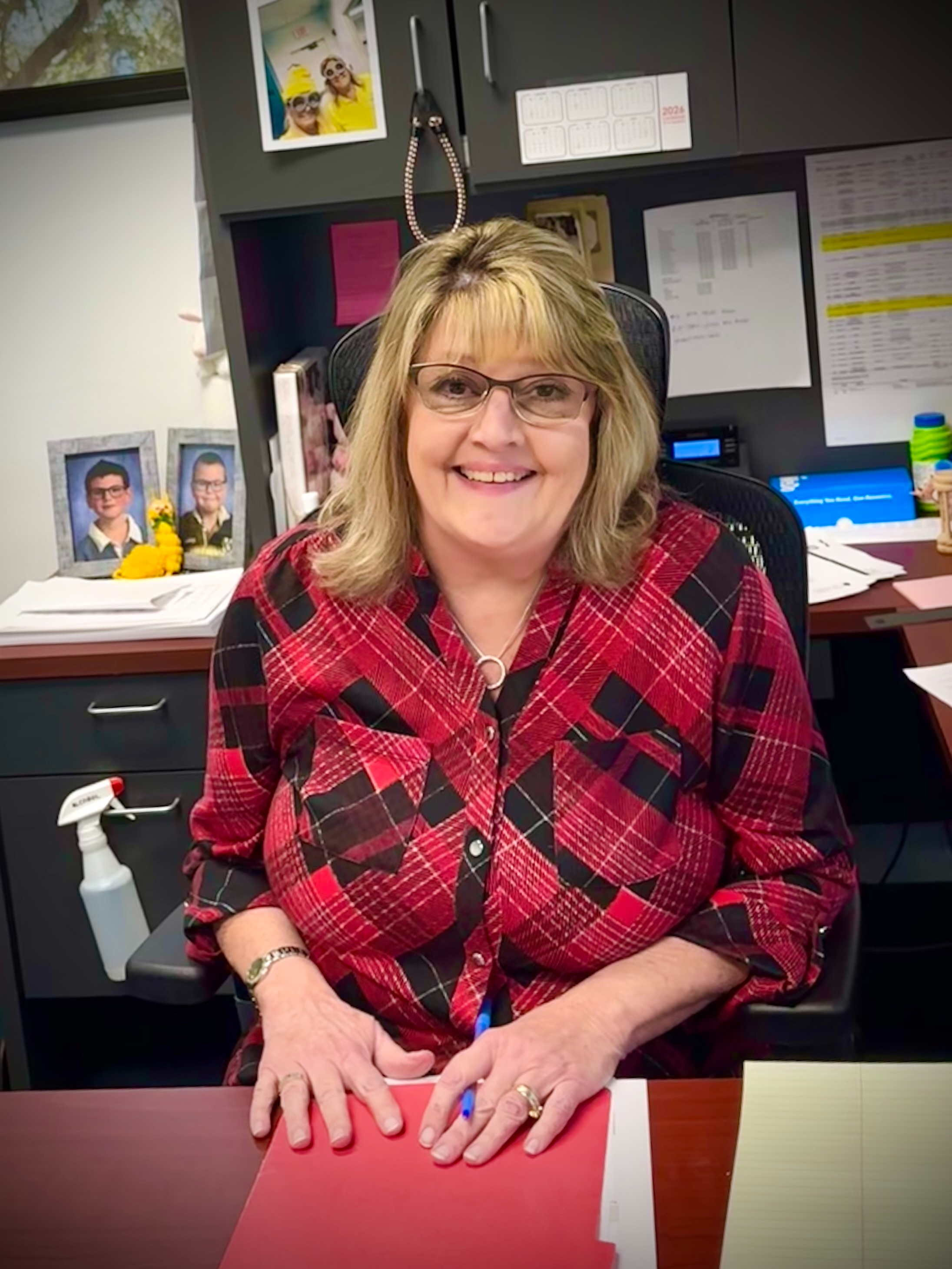

Linda Stevens

- Accounting / Accounts Payable Manager

- (813) 879-4525 Ext. 226

Linda Stevens is our Accounting and Accounts Payable Manager and has over 25 years of banking operations, 15 of which were with The Business Bank in Northern Virginia. Seven of those years, she worked remotely after moving to the Tampa area in 2007.

She joined NLP in January of 2015 as an accounting assistant.

She handles day to day general ledger activity as well as accounts payable. She is responsible for reconciling and maintaining bank accounts and various general ledger accounts on a monthly basis, as well as other duties consistent with her position.

-

Jennifer Bryant

- Loan Servicing Assistant

- (813) 879-4525 Ext. 228

Jenn assists in servicing NLP’s multi-million-dollar loan portfolio for affordable housing from construction phase to permanent phase and until the loan matures. Jenn is also responsible for assisting with general ledger activity as well as accounts payable. She is the default back up person and cross supports all departments.